programme benefits

World-Class Faculty

Learn from the best in the industry

Dedicated Support

Get answers to all your queries super quick

Career Services

Avail lifetime placement and career assistance

60+

Hours Live Lectures

18+

World Class Faculty

300+

Hiring Partners

90+

Countries Alumni Network

PLACEMENT PARTNERS

programme features

Project work opportunity

Project work opportunity

Scholarships and Financial Aid

Scholarships and Financial Aid

Lifetime access to latest course content

Lifetime access to latest course content

Verified Certification from QuantInsti, UNICOM and OptiRisk

Verified Certification from QuantInsti, UNICOM and OptiRisk

Exclusive Community benefits

Exclusive Community benefits

Gain industry exposure with comprehensive Case Studies

Gain industry exposure with comprehensive Case Studies

Speak to a counsellor

You can always reach to us at

Curriculum

1 Primer

- Knowledge of basic trading procedures and basics of algorithmic trading: know and understand the terminology

- Understand statistical methods and statistical measurements including autocorrelation function, partial autocorrelation function, Maximum Likelihood Estimation (MLE), Akaike Information Criterion (AIC), Mean Absolute Error (MAE), Root Mean Squared Error (RMSE)

- Basic knowledge of time series analysis, stationarity of time series, and forecasting using ARIMA

- Fundamentals of Autoregressive and GARCH Models, and understanding volatility

- Logistic regression to predict the conditional probability of the market direction

- Different methodologies of evaluating portfolio and strategy performance (back-testing methodologies and statistical figures for evaluation including Sharpe ratio, Sortino ratio, Max drawdown)

- Basic knowledge of Asset Allocation Models

- Understand all the most practical indicators and oscillators (e.g., RSI, MA, EMA)

- Distinguish between Macroeconomic and Microeconomic news

- Basic knowledge of models for spot prices, futures prices

- General knowledge of types of multifactor models and updating a traditional factor model

- Knowledge on the basics of the financial market in general and the stock market in particular

- A clear understanding of the type of instruments and the stock markets.

- Understand the concept of the stock market index and its calculation

- Basic knowledge of machine learning, pattern recognition as well as Natural Language Processing (NLP)

2 Module 1: Sentiment: What and Whose

- Understanding investor sentiment and the pendulum of investors’ emotions

- The role of “Noise Traders” in driving the asset prices in the financial markets

- Media sentiment and how it affects asset prices

- Market sentiment and its measurement

- Determining crowd sentiment and its impact on financial markets

3 Module 2: Sentiment Data

- Classical newswires and macroeconomic announcements

- Various Sources of sentiment data such as news, social media, and search engines

- The impact of Micro-blogging platforms on stock markets

- Converting qualitative information to the sentiment score

- Using bag-of-words, natural language processing and lexicon-based methods in sentiment analysis

4 Module 3: Structure and Coverage

- News analytics (Meta) data structure

- The exact polarity of sentiment in the news

- News characteristics such as relevance, novelty, and sentiment scores

- Leading data providers for sentiment data analysis in finance

- Description of the data provided by major sentiment vendors

5 Module 4: Other Sources: Alternative Data (I)

- Scheduled (expected) and Unscheduled (unexpected) financial news

- Macroeconomic news and their usage in automated trading

- Relevance and use of alternative data in sentiment analysis

- Major types of alternative data

- Different categories of alternative data such as satellite data, geolocation data, etc.

- Providers of alternative data

- Taxonomy of models

6 Module 5: Models to Exploit Sentiment Analysis (I)

- Taxonomy of models

- Descriptive, normative, prescriptive and decision models explained

- Modelling and information architecture

- Examples of modelling in the domain of finance

- The key role of time and uncertainty in decision making

7 Module 6: Models to Exploit Sentiment Analysis (II)

- Financial applications of sentiment data and their properties

- Risk management through risk quantification: risk computed for exposures of varying time spans, namely, weekly, monthly, or annualized

- Fund rebalancing on calendar dates: weekly, monthly, yearly

- Automated trading daily or intraday

- Retail application (creditworthiness, loan, and savings advice)

8 Module 7: Opinion and Biases

- Various challenges in the area of sentiment analysis

- Distinction between opinions and facts

- Role of behavioural finance in investor decision making

- Different types of biases that affect investor behaviour in financial markets

- Revisiting the pendulum of fear and greed

9 Module 8: AI, Machine Learning & Quantitative Models to predict market direction

- Quant models and AI & ML models- overview

- Interaction of Quant Models and AI & ML models to predict market direction

- Supervised and Unsupervised learning models

- Models for predicting market direction: K-Nearest Neighbor, Decision Tree Models, ANN, LSTM, SVM

- Trading Strategies using Quantitative Models and Machine Learning

10 Module 9: Role of Alternative Data in Financial Trading: Alternative Data (II)

- Rapid growth of Alternative Data in recent decades

- Improvement of technical ability to process data

- Categorization of Alternative Data and Application in Finance

- Use of Alternative Data to obtain insight into the Investment process

- Capture the predictive power of Alternative Data in Financial Trading

11 CSAF Exam

- CSAF requires you to successfully clear the Examination

- The exam is conducted in a proctored environment both at the Prometric centres in 80+ countries and remotely

Case studies

1 Grasping Behavioural Finance by Anthony Luciani

- MarketPsych has built a sentiment analytics suite on investor-relevant media from thousands of online sources with hundreds of over-arching themes and topics covering all major asset classes.

- In these sessions, we explore how the stationary processes of psychology interact with the nonstationary processes of financial markets.

- Witness two major themes of investor over- and under-reaction to the news.

- See cycles of fear and their interactions with crude oil prices.

- Find solutions to common questions within the field of sentiment analysis for markets.

- Observe how new themes become more predictive over time.

2 Classifying Earnings Calls & News by Dan Joldzic

- Alexandria Technology develops natural language processing (NLP) software to convert text into data.

- Alexandria uses machine learning to identify key phrases in financial documents such as news reports, press releases, earnings calls, and filings.

- There are official sources of information such as newswires (Dow, Reuters, Bloomberg), company filings (10-Qs, 10-Ks), earnings calls, research reports.

- News classification and its impact on asset returns.

- Two types of news: company-specific news and economic news.

- News works better on short time horizons like 1 week or lesser. For greater time horizons, alpha decays.

- Unstructured news can be converted to structured data showing information on Ticker, topic and sentiment score.

- We look at the ratio of positive news reports to negative news reports of a company on a day to create a sentiment score. These companies belong to the US all cap.

3 NLP And ML Techniques in Finance: Some Examples by Dr. Matteo Campellone

- Datasets based on proprietary algorithms as Alternative Data.

- Introduction to the Brain Sentiment Indicator.

- Introduction to the Brain Language Metrics on Company Filings dataset.

- A workflow that uses ML and NLP for thematic selection.

4 Asset Allocation Enhanced by Sentiment Data by Dr. Zryan Sadik and Prof. Christina Erlwein-Sayer

- Introduction and Background.

- Market Data and News Data.

- Asset Allocation Strategy.

- Construction of Filters.

- Empirical Investigation.

- Discussions and Conclusion.

5 ESG in Factors by Dr. Katharina Schwaiger

- Environmental, social, and governance (ESG) signals are an important part of factor-based investing strategies as they can stem from the same economic rationales as general factor premiums.

- Because factors are broad and diversified, building portfolios by jointly optimizing factor exposures with ESG and carbon outcomes can result in similar historical performance as benchmark factor portfolios that do not include those considerations.

- We show how sustainable signals, which often involve alternative data, can be integrated into the definitions of factors themselves.

- We offer two examples of green intangible value and corporate culture quality which enhance traditional financial value and quality factors, respectively.

6 Using traditional structured data for long-term analysis of publicly-traded equity and using alternative, unstructured data for short-term analysis of public and private equity by Dr Keith Black

- Quantitative investors have long used traditional data sources, such as income statements and balance sheets of public firms, to drive stock selection models.

- Factors such as value, growth, earnings quality, and earnings surprise can be effective at predicting the long-term performance of publicly-traded stocks.

- With the explosion in the amount and diversity of data in the last five years, alternative data sources are quickly revolutionizing quantitative investing.

- Alternative data sources can include natural language processing of news and social media content, review of credit card transactions and consumer emails, and geolocation data using cell phone signals and satellite images.

- Alternative data is more complex to process, moves in a different time frame than traditional data and may provide a new window into information availability for private companies.

7 News Sentiment Analysis in Em Sovereign Debt research, Investment and Risk Management by Jacob Gelfand and Kamilla Kasymova

- We present the internally developed framework for ex-ante analysis of the foreign exchange and sovereign bond markets based on the news sentiment in global and local media, the Global Economy and Markets Sentiment (GEMS) model.

- The predictive analytics from the GEMS model are used to enhance the fundamental analysis to better assess risks and opportunities in the Emerging Markets sovereign debt market.

- We introduce the long-term and short-term trading strategies based on the produced GEMS analytics and spearhead the discussion about the predictive qualities of the produced analytics.

8 The Art of (Alternative) Data Science by Ganesh Mani

- The dynamic world produces data that is constantly changing. Financial markets can be particularly mercurial, triggered by geopolitical events, regulation changes, industry news and the earnings outlook of companies.

- Exploiting data science to explain or predict the ebb and flow of security prices can be a bit of an art. Knowing which data – from the plethora of traditional and alternative datasets – to focus on, what techniques to use (e.g., traditional statistical, historical-data-intensive deep learning, reinforcement learning, forward-looking simulations or a combination); and, what aspects to the model are nuanced decisions that will significantly affect portfolio risk and return.

- Human-machine teaming is also a focus area and I hope to address some of the above themes in my brief presentation. A subsequent panel will elicit multiple opinions in this milieu.

9 Using alternative data: from research to production by David Jessop

- The use of alternative data is a necessary part of many investment processes running today.

- There is, however, a difference between running a one-off analysis and having a regular process running in production.

- In this lecture, we will provide some advice and suggestions for all stages of this process.

10 ESG Data and Investment Returns by Richard Peterson

- Learn How Esg Perceptions And Controversies Are Detected In News And Social Media Using AI.

- Identify Which Esg Factors Have Been Leading Shares Higher, And Which Are Irrelevant (Or Even Damaging) To Shareholder Value.

- See How Specific ESGH Controversies Affect Corporate Share Valuations Over Time.

11 A Quantitative Metric for Corporate Sustainability by Dan DiBartolomeo

- In recent years the concept of “sustainability” companies has been at the forefront of concerns for many investors. As most consideration of sustainability has focused on the broad ideas of ESG concerns (Environmental, Social, Governance) the field has lacked a straightforward metric by which investors can assess “How many years into the future is a given company likely to survive without bankruptcy?”.

- While somewhat similar to a credit rating, such a measure must also consider the situation of firms with no current debt, and those that are pathologically conservative so as to survive until eventually becoming obsolete.

- Such a metric was introduced by Dan diBartolomeo (Journal of Investing, 2010) based on an extension of the Merton contingent-claims model (Journal of Finance, 1974). In this study, we illustrate refinements of the methodology and present empirical analysis of the relationship between the sustainability metric and investor returns from 1992 through 2021 for all equities traded on US exchanges (inclusive of non-US firms traded in ADR form).

- The results show statistically significant relationships that may be exploited for superior returns in both equity and corporate bond markets.

12 Creating a strategy using Machine Learning by Dr. Ernest Chan

- Most investors found it hard to generate sustainable alpha by machine learning.

- Machine learning algorithms are the ultimate "Black Boxes", offering no hint on why a trade is made.

- Those characteristics have impeded the adoption of machine learning in asset management.

- However, Corrective AI and Conditional Portfolio Optimization are two machine learning methods that have the potential to bring practical benefits to asset management.

- Corrective AI is the use of machine learning to compute a probability of profit of an existing trading strategy, while Conditional Portfolio Optimization is the use of machine learning for portfolio optimization.

- This lecture will discuss why these methods both work better and provide more transparency than traditional applications of ML to asset management.

13 Discussion on Project Results

- Objectives: To introduce to the participants a guideline for preparing technical reports of empirical investigations; how to develop an experimental project; and simultaneously prepare for report writing.

- Learning Outcomes: Develop a generic approach to preparing Technical Reports and develop reports collaboratively as a team.

Project Work

1 Introduction to News Data

- In this session, we get acquainted with the sample of news analytics data provided as part of the course. The data is provided for a selection of American stocks. We process both market data and news data and produce some data visualisations as well as a suggested rolling sentiment score for the S&P500 index.

2 Producing your own News Sentiment

- The main goal of this session is to produce news analytics from news headlines. We collect publicly available headlines for specific companies from a website via a simple web scraper. We then use a natural language processing package in Python to produce news sentiment based on the collected data.

3 News Impact Calculation (I)

- In these sessions, we first give a short lecture on the concept of news impact scores. We then proceed to develop a notebook which calculates news impact for the sample data provided. We start by transforming the multiple scores into a single News Sentiment Value (NSV).

4 News Impact Calculation (II)

- We implement the calculation of news impact based on NSV. Finally, we produce some data visualisations based on the news impact series.

5 Momentum-based Strategy

- In this session, we first give a short lecture on the calculation of news impact-based momentum. We then implement the momentum calculation in a notebook and produce an investment strategy based on the momentum series. The strategy may invest in any of the stocks provided, as well as a risk-free asset. We also implement a simple backtesting tool in order to test different configurations of the strategy.

6 Portfolio Optimisation (I)

- In these sessions, we implement the Markowitz model for portfolio optimisation. Instead of using Python packages that solve this model, we implement it from scratch. This allows us to easily customise the optimisation model in order to generate more desirable portfolios. We then use news impact in order to produce different configurations of the Markowitz model. We produce backtesting results for a few configurations.

7 Portfolio Optimisation (II)

- We use news impact in order to produce different configurations of the Markowitz model. We produce back-testing results for a few configurations.

8 Discussion on Project Results

- Objective: To introduce to the participants a guideline for preparing technical reports of empirical investigations; how to develop an experimental project; and simultaneously prepare for report writing.

- Learning Outcome: Develop a generic approach to preparing Technical Reports and develop reports collaboratively as a team.

- Note: Students attending the Hands-on Project session will get access to Sentiment data from multiple data providers.

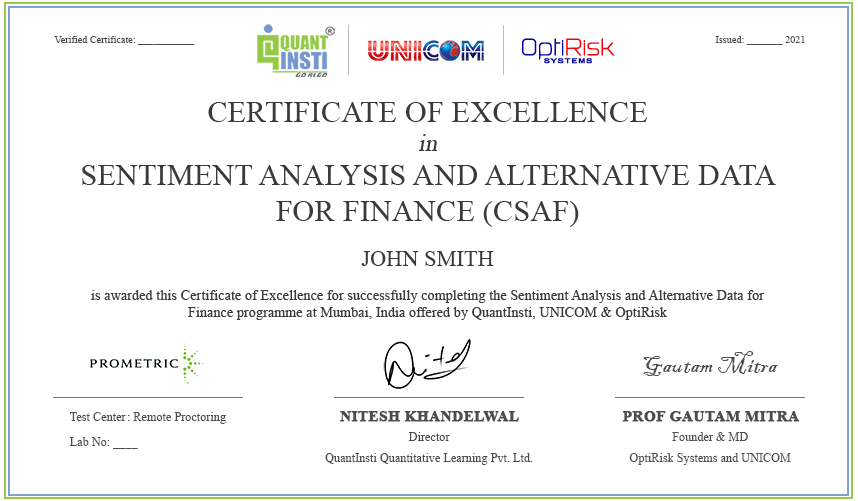

Certificate

CSAF is provided by QuantInsti, UNICOM and OptiRisk

QuantInsti is one of the world's biggest algorithmic & quantitative trading institutes, and today, it has learners from 200+ countries and territories.

Established in 1984, UNICOM is an events and training company specialising in the areas of Quantitative Finance and many aspects of IT.

Click to zoom

Faculty Members

ADMISSION PROCESS

Send your

Application

Get on a call

with a Expert

Application

acceptance

Pay the fee

and get started

Send your

Application

Get on a call

with a Counsellor

Application

acceptance

Pay the fee

and get started

Before admission, we will facilitate a one-on-one counselling session that will focus on understanding the strengths and weaknesses of the participant. These sessions do not necessarily decide the participants' eligibility but help counsellors assist them with informed guidance prior to enrollment.

This programme aims to serve the participants who are equipped with high intellectual curiosity, possess a strong interest in finance and have analytical skills. This includes participants who come from various quantitative disciplines such as mathematics, statistics, physical sciences, engineering, operational research, computer science, finance or economics.

Course Duration

60 hours including live sessions on case studies and project work

Lecture Duration

3 hours every weekend over Saturday and Sunday

Standard Programme Fees

| Tier | Applicable till | Global Participants | Indian Residents* |

|---|---|---|---|

| Super Early Bird Enrollment Fees | 20th December 2022 | 2,999 | 1,49,900 |

| Early Enrollment Fees | 24th January 2023 | 3,349 | 1,69,900 |

| Standard Enrollment Fees | 17th March 2023 | 3,699 | 1,89,900 |

Financial Aid

CSAF® programme comes with Financial Assistance for the eligible participants

Scholarship by QuantInsti

Participants (Other than full time student) can Earn the Merit-based Scholarship. Go get it here!

Flexible Payment Plans

Flexible Payment Plans are available at 0% interest for full-time Indian residents. View EMI plans

Student Aid

QuantInsti encourages full-time students to enter this domain. Claim your benefits, if you are still pursuing full-time education.

Emerging Market Fee

Emerging market participants (Participants residing full time in countries with per capita GDP (nominal) less than USD 20,000 as per World Bank data), please share your details below to check for Emerging market fee eligibility.

FAQ

What are the fees for CSAF?

The complete fee details can be found in the admission section.

Can I register for EPAT and CSAF at the same time?

Yes, you may register for both at the same time, provided you are confident that you can keep up with the additional training hours.

Would I get a refund if I change my mind after enrolling on the programme?

We provide an opportunity to clear all your doubts about the programme prior to enrollment. Also, you get access to dedicated team support. Therefore, we follow a no refund policy.

What financial assistance is available?

Financial assistance provided to qualified applicants include but are not limited to the following:

- Student discounts - QuantInsti believes in investing in the future of tomorrow, the students of today. We have a discounted fee for full-time students.

- Participants from Emerging Markets - Special consideration is given to participants from Emerging Markets so that the programme is more affordable.

- Educational Loans - QuantInsti is partnered with financial institutes that provide education-related loans to Indian resident participants.

Get in touch with our programme counsellors here.

What is the admission process for CSAF?

It is a simple three step process:

- Submit your application form here.

- Wait for your application to get accepted.

- Pay the fees.

Soon after the successful receipt of your EPAT fees & acceptance, you are given access to the learning management system (LMS portal) and your EPAT journey begins!

Before admission, we offer to facilitate a one-on-one counselling session that will focus on understanding the strengths and weaknesses of the participant. These sessions do not necessarily decide the participants’ eligibility but help counsellors assist them with informed guidance prior to enrolment.

What is the procedure for Educational Loan?

QuantInsti has partnered with government approved NBFCs to facilitate 0% financial assistance with minimal documentation for the Indian resident participants. To apply for the assistance, you would be required to share following documents with QuantInsti:

- First and Last Name

- Scanned Copy of PAN Card & Aadhaar Card - This will help to generate your CIBIL score

- Last three months pay slip (in case of a salaried employee) or last three year filed ITR (in case of self-employed)

- Last 4 months bank statement

Once you share the mentioned documents, your programme manager will connect you with the respective NBFC associates. Respective NBFC will share the sanction letter (loan approval letter) on loan approval, and you can proceed with the downpayment as per the plan agreed with the NBFC associate.

On receipt of a defined downpayment and the payment from partnered NBFC, you'll get access to the Learning Management System (Primer Modules) to kick off your Algo and Quant learning journey.

What is the last date to apply for the upcoming batch?

The updated dates and fees related information is available here.

As an EPAT alumnus, what special benefits or discounts will I get for CSAF?

Special discounts are available for EPAT alumni. Please connect with your programme manager for more details.

What are the course requirements?

A personal machine with a good internet connection is all that is required to get started immediately. As soon as you enrol, you will be provided with learning material that will assist you through the entire duration of the programme. We recommend giving 15-20 hours per week to review and complete the course work within a period of 5 months before proceeding to the final exam.

Will I get a certificate for this programme?

Yes, you would be getting a certificate from QuantInsti and Unicom, post successful completion of the programme.

What are the modules covered in this programme?

7 modules are covered in total. You can check out the curriculum for complete details of these modules.

What is the duration of the programme?

The duration of the programme is about 4 months. The live sessions would be conducted over the weekends (Saturday and Sunday) for this duration.

Who are the faculty for this course?

You can check the complete details of the faculty here.

How many hours of commitment is required on a weekly basis to perform well in the programme?

Typically 15-20 hours including 3-4 hours of live lectures are required weekly to do well in the programme.

What are my options if I can’t complete programme requirements within the allotted period of time? Can I move to a later batch?

Your dedicated Support Manager will help you throughout the programme to ensure that you do not lag behind. Even if it happens, then depending on the completion date, you may choose the self-paced learning option available with a few months of extension. You can apply for a batch defer to a later one, before the starting date of your enrolled batch. If your application is complete along with all required documents and it fulfils the required criteria, you could be moved to a later batch.

What is the minimum passing requirement for passing the CSAF exam?

The minimum requirements to be eligible for ‘Certification of Excellence’ includes a certain percentage of:

- Attendance in lectures or time spent watching the recordings

- Score in quizzes and assignments

- Score in the final examination

What are the prerequisites to start with the programme?

You need to have:

- A personal computer with the minimum configuration as: Operating system such as Windows: (Windows 8, Windows 8.1, Windows 10) or Mac: Mac (v 10.10), Mac(v 10.11), Mac(v 10.12), Mac(v 10.13).

- Additionally, you will need some software/programming languages installed on your system in order to have hands-on experience as well as finishing the program. The list of required software and the installation manuals will be shared with you before the programme starts.

- Language skills: You should be able to understand spoken and written English well.

- Enough time and motivation: You should be able to devote 15-20 hours on a weekly basis. The more the better!

Would the recordings of the lectures be provided?

Yes. Recordings of all the lectures would be made available to you on the LMS, once they are Live.

How to attend the sessions?

You can attend the sessions online with the link shared by the Support team to attend the lecture.

How will the lectures be conducted?

The lectures would be completely online.

When will the live sessions be conducted?

The live sessions would be conducted in evening hours in IST (after 1100 GMT) over the weekend ie. Saturday and Sunday.

How will the exam be conducted?

The exams would be conducted online and at Prometric centres globally. Participants can opt for either a remotely proctored exam (given they meet the pre-requisites) or write the exam at Prometric centres globally.

Are there any case studies explained in this course?

Yes, there are 6 case studies covered. You can check this section for complete details.

Would I get support for learning?

Yes. You would get continuous support from the Support Team throughout the programme.

Can I attend classroom sessions?

CSAF is 100% online. But, yes, you can attend a few classroom sessions in Mumbai, India, when the concerned faculty is based in Mumbai. Since most of the faculty members are located outside Mumbai, even if you are present in the QuantInsti classroom, you will be attending the lecture online. The weekly announcements mention the sessions happening in Mumbai. You can opt for writing the exam at your nearby centre of our exam partner or remotely from home, given the pre-requisites are met.

How will I, as a CSAF participant, interact with faculty members?

You will interact with the faculty in many ways:

- During the lecture you get to interact with the faculty

- Post or before the lecture, you get to share your doubts and queries which will be resolved by the faculty

- You can also interact with faculty through your support manager anytime

What kind of help/assistance is available to a CSAF participant?

- A dedicated Support Manager will guide you for the entire period of six months. Your manager will resolve your doubts and keep you motivated and engaged in this new and demanding career path

- You will get advice and answers from the faculty members who are industry practitioners

- We will share additional links & content with you to further enhance your learning

- A dedicated alumni cell is available post-completion to help you grow in the algo domain and network with fellow alumnus

- Lifelong access to updated lecture notes and videos after you complete the CSAF course successfully

How can I write the CSAF exam?

CSAF Exams are conducted at the Prometric centres globally. Every year, there are four exam windows/weeks, during which you can schedule your own exam based on the availability of the slot at the nearest Prometric centre in your country. You may also write an exam using the Remote proctoring basis availability.

Your account manager will help you with the details. Just share your city, country and postal code with your account manager and (s)he will share the nearest centre. Also, with every batch, new centres are added, hence, you should check for the exam centre for the upcoming exams only.

One month prior to the exam, you will get an email from the Support team, explaining the process for scheduling your exam. Additionally, you may call your support manager who will guide you to schedule your exam.

What happens if I fail the exam or am unable to write the exam?

We understand your concern and respect the efforts that you put into learning. So, we may provide you with a chance to re-attempting the exam. You can check with your support manager for a detailed process. Rescheduling charges may be applicable for scheduling the exam beyond your batch exam window.

What does QuantInsti do?

QuantInsti® is one of the world's biggest algorithmic & quantitative trading institutes. From its early days, QuantInsti focused on bridging the industry knowledge gap in the field of high-frequency trading and has come a long way in the last decade. Today, it has learners from 200+ countries and territories.

QuantInsti was founded by Algorithmic & High-Frequency Traders and Experts in 2010 with the goal of democratizing Algorithmic & Quantitative Trading for everyone through educational and technological solutions. QuantInsti is a venture by iRage, one of the leading HFT and Algorithmic trading firms in India.

Blueshift is a FREE platform to bring institutional class infrastructure for investment research, backtesting and algorithmic trading to everyone; anywhere and anytime. It is a fast, flexible and reliable platform that helps you turn your ideas into trading strategies. You can research your ideas, backtest them, and take your strategies live with a broker of your choice.

- Modern methods in finance: CSAF

The Certificate in Sentiment Analysis and Alternative Data for Finance (CSAF) programme is designed for finance professionals who are looking to develop their careers in modern methods in finance using News, Sentiment Analysis and Alternative Data.

Free Services

- Webinars

- Blogs, tutorials and trading models

- Algorithmic trading workshops, events and modules for exchanges and industry